risks associated with closed end funds

As a result some income investors start buying into Closed End Funds CEFs. The value of a CEF can decrease due to movements in.

What Are Closed End Funds Forbes Advisor

So if you buy an SP 500 ETF and the SP 500 goes down 50 nothing about how cheap tax efficient or transparent an ETF is will help you.

. Like a mutual fund or a closed-end fund ETFs are only an investment vehiclea wrapper for their underlying investment. A closed-end fund or CEF is an investment company that is managed by an investment firm. Most will attempt to.

Closed-end funds CEFs can be one solution with yields averaging 673. Prices may swing from one high value to a low value point all in one days trading action. CEFs are sometimes described as ancestors to exchange-traded funds but CEFs have a fixed number of shares while ETFs can raise or lower the figure as demand changes.

Principal loss is possible. Investing in closed-end funds involves risks. What are the risks associated with Closed-end Funds.

Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify investment income through low-cost leverage. Income earned by a mutual fund is a. Here are some clues with examples that show potential closed-end fund problems.

Trading in such portfolios requires research and analysis before such investment. Ad Learn why mutual funds may not be tailored to meet your retirement needs. Like any investment product closed-end funds come with a range of risks which well cover next.

23 2011 751 AM ET ZF ETG GGN. Their yields range from 632 on average for bond CEFs to. CEFs are subject to market volatility and the risks of their underlying securities which might include the risks associated with investing in smaller.

A Closed End Fund CEF is an investment company which is listed on an exchange and traded intraday at prices determined by supply and demand in the market similar to stocks. That means the CEF share. Small- and mid-cap securities may be subject to special risks associated with narrower product lines and limited.

The risks associated with this type of fund mainly include market risk and how that can affect pricing. There is no guarantee a funds investment objective will be achieved. A closed-end fund is one of three main types of investment companies that the Securities and Exchange Commission regulates.

All bond closed-end funds are subject to some degree of market risk and credit risk. This can be a retail product for those who can stomach the associated risks in their search for relatively high-potential income and gains. The Allspring Income Opportunities Fund is a closed-end high-yield bond fund.

The two other main types of investment companies are open-end funds including mutual funds and exchange-traded funds or ETFs and unit investment trusts UITs. Closed-end funds CEFs can be popular vehicles for portfolio diversification in the long-term although these funds come with certain volatility risks. Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds.

Risks associated with closed end funds. Closed-end funds trade on exchanges at prices that may be more or less than their NAVs. Closed-end funds provide exchange-traded flexibility income potential ability to tap into specialized asset classes and lower investment minimums.

Closed-end funds can offer advisers opportunities to. Many fund managers are not very forthcoming about what the own in the portfolios and how they implement investment strategies. Each closed end fund has a different amount of.

If stocks experience a bout of volatility then that can cause fund prices to fluctuate as well. There are several types of closed-end funds with unique. At year-end 2021 assets in bond closed-end funds were 186 billion or 60 percent of closed-end fund assets.

There are varying levels of risks associated with each closed end fund. The group includes stock funds bond funds and hybrid funds. An SEC-registered investment adviser and is associated Dow Wealth Management LLC.

This article originally appeared on Sarasota Herald-Tribune. This increases the risk and possibly the return. A Primer On Risk for the Closed End Fund Investor.

Closed-end Funds have hidden risks for investors. Like a traditional open-end mutual fund a closed-end fund is a professionally managed investment company that pools investors capital and invests in stocks bonds or other securities according. Prices might fluctuate from a high to a low value point in a single days trading activity.

Get specialized trading support with people who know the markets share your passion. In secondary markets closed end fund shares are frequently accompanied by considerable trading volatility. Other fund operational risks may arise following the termination of the fund such as the following.

Like any investment product closed-end funds offer opportunity but also come with a number of risks some of which are listed below. As always it is important to consider the objectives risks charges and expenses of any fund before investing. Just like open-ended funds closed-end funds are subject to market movements and volatility.

Evaluating individual closed-end funds can be frustrating. The single biggest risk in ETFs is market risk. A lot of the funds in the closed-end fund space use leverage.

There can be no assurance that fund objectives will be achieved. Shares of closed end funds in secondary markets are often accompanied by high volatility in trading. Similar to open-end funds closed-end funds are just as susceptible to market fluctuations and volatility.

Ad We offer a complete package with intuitive tools for traders who wont compromise. Closed-end funds raise a certain amount of money through an initial public. Seeks to outperform the stock market c.

Market risk is the risk that interest rates will rise lowering the value of bonds held in the funds portfolio. Answer 1 of 2. What are the risks associated with Closed-end Funds.

Closed-end fund shares also carry risks investors should understand. And this was typically historically this has typically been from preferred shares. CEF values can drop due to the overall movements in the.

Market Risk Of Capital Loss. Expense ratios or the cost of owning the fund each year may also be lower compared to some open-end funds. Our goal is to create a safe and engaging place for users to connect over interests and.

All the strategies associated with stocks such as market orders limit orders stop orders short sales and margin buying can be used in the purchase and sale of closed-end funds. Get this must-read guide if you are considering investing in mutual funds. Now we will discuss risks associated with CEFs.

Closed-end fund definition. CEFs are primarily designed for clients with longer-term investment strategies and in the long run may very well produce higher rates of return and overall income than open-end mutual funds. One type is Closed-end Funds.

Difference Between Open Ended And Closed Ended Mutual Funds

What Are Closed End Funds 3 Risks That Destroy Wealth Finance Advice Bond Funds Fund

What Are Mutual Funds 365 Financial Analyst

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Capital Protection Oriented And Dual Advantage Mutual Funds Mutuals Funds Investing Fund

Steady Income With Closed End Funds For Monthly Paid Dividends Investing Tips Essential Guide Dividend Investing Investing Investing Strategy

What Are Closed End Funds Fidelity

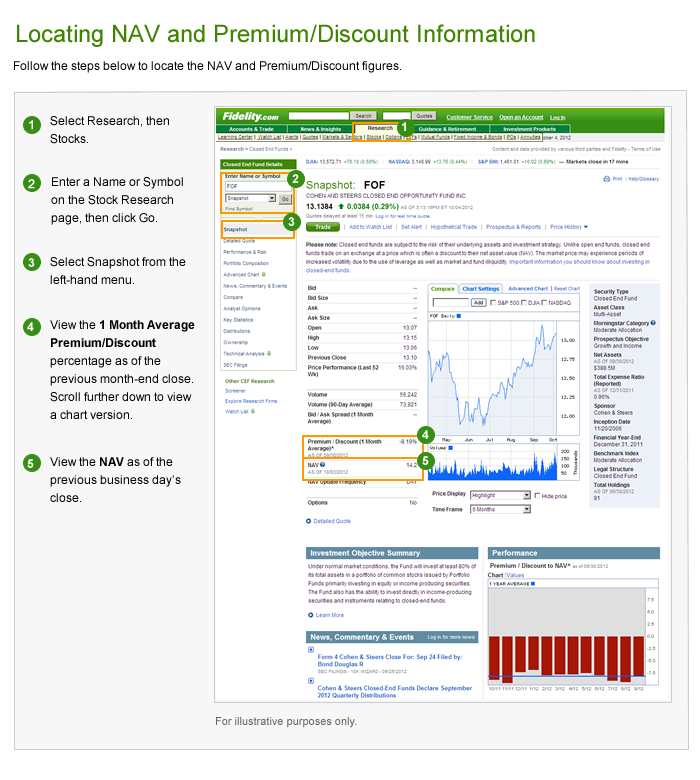

Closed End Fund Cef Discounts And Premiums Fidelity

Birla Sun Life Emerging Leaders Fund Series 3 Let Your Ambitions Soar Higher With Us High Potential Discovered Early A Closed E Investing Mutuals Funds Fund

Difference Between Open Ended And Closed Ended Mutual Funds

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Understanding Closed End Vs Open End Funds What S The Difference

Open Ended Vs Closed Ended Funds Stock Market Fund Management How To Raise Money

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Rr Investors Offers Nfo Uti Capital Protection Oriented Scheme Series Iv I 1103 Days Http Goo Gl Bnxohr Mutuals Funds Investing Fund

Advantages Of Mutual Fund Elss Schemes Over Other Tax Saving Instruments 1 Income Tax Benefit Under Section 80 C 2 Brigh Mutuals Funds Investing Dividend

Morningstar Investment Research Center Provides Real Time Access To Comprehensive Data And Independent Analysis On Investing Online Resources Research Centre

/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)